Are you an HVAC contractor? If yes, you need insurance. Insurance protects your business. It helps you manage risks and stay safe.

Why is Insurance Important for HVAC Contractors?

HVAC work involves risks. You deal with heavy machinery. You work with electrical systems. Accidents can happen. Insurance covers these risks. It protects you and your clients.

Protect Your Business

Accidents can ruin your business. A simple mistake can lead to big costs. Insurance can help cover these costs. It ensures your business survives.

Build Trust With Clients

Clients trust insured contractors more. They feel safe knowing you have coverage. It shows you are professional and prepared.

Credit: www.otterstedt.com

Types of Insurance for HVAC Contractors

There are different types of insurance. Each type covers different risks. Let’s look at the main types you need.

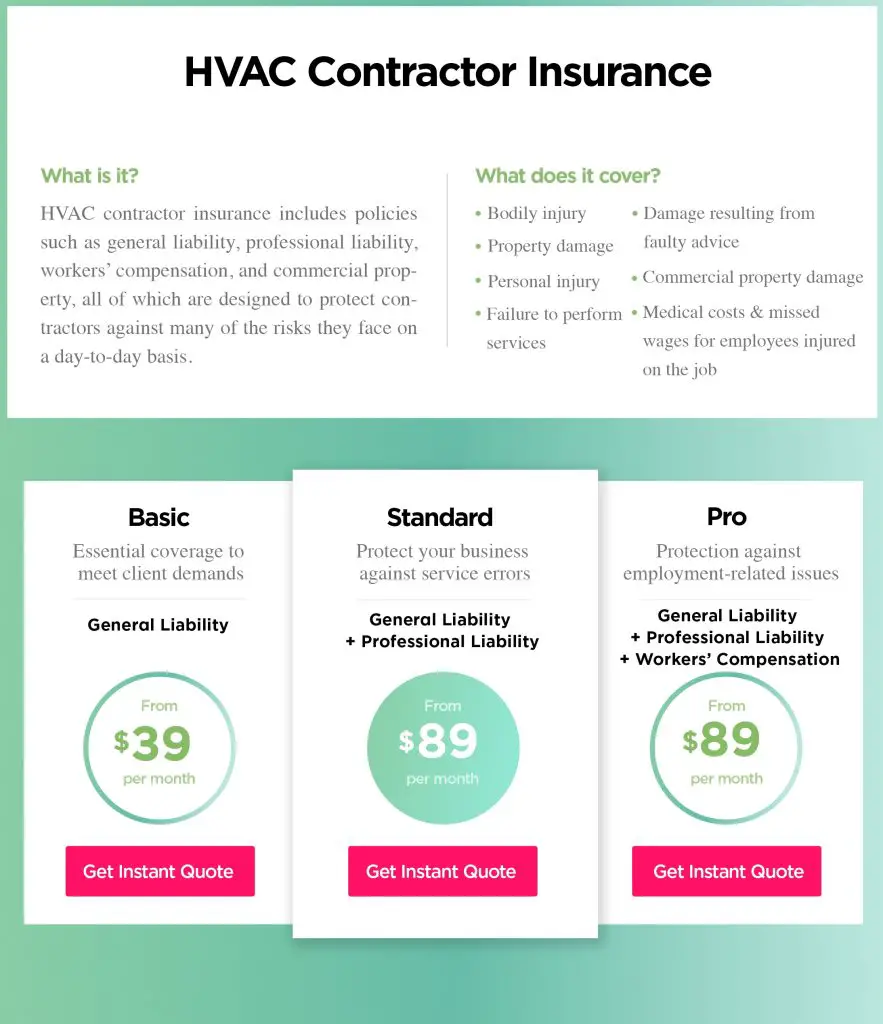

General Liability Insurance

This is a must-have. It covers bodily injuries. It also covers property damage. For example, if you damage a client’s property, this insurance helps.

Workers’ Compensation Insurance

This is for your employees. It covers medical costs if they get hurt. It also covers lost wages. In many places, it is a legal requirement.

Commercial Auto Insurance

You use vehicles for your work. This insurance covers those vehicles. It covers accidents, theft, and damage. It is crucial for contractors.

Professional Liability Insurance

This covers mistakes in your work. It is also called Errors and Omissions insurance. If a client sues you for poor work, this helps cover the costs.

Tools And Equipment Insurance

Your tools are valuable. This insurance covers them. It covers theft, loss, and damage. It ensures you can keep working.

How to Get the Best Insurance Coverage

Getting the right insurance is key. Here are some steps to help you.

Assess Your Needs

Look at your business. What risks do you face? Make a list. This will help you choose the right coverage.

Compare Quotes

Don’t just pick the first insurance you find. Get quotes from different companies. Compare the coverage and costs. This way, you get the best deal.

Read The Fine Print

Always read the policy details. Understand what is covered. Look for any exclusions. This will prevent surprises later.

Work With An Agent

An insurance agent can help. They know the industry. They can guide you to the best policies. They make the process easier.

Credit: www.hiscox.com

Common Questions About HVAC Insurance

You might have questions. Here are some common ones and their answers.

Do I Really Need Insurance?

Yes, you do. Insurance protects your business. It helps you handle risks. It is essential for any HVAC contractor.

How Much Does It Cost?

Costs vary. It depends on your coverage. It also depends on your business size. Get quotes to find out the cost for you.

Can I Bundle Insurance Policies?

Yes, you can. Many companies offer bundles. This can save you money. It also makes managing insurance easier.

What Happens If I Don’t Have Insurance?

You risk a lot. You could face huge costs. You might lose clients. In some places, you could face legal issues.

Frequently Asked Questions

What Insurance Do Hvac Contractors Need?

HVAC contractors need general liability, workers’ compensation, and commercial auto insurance for comprehensive coverage.

Why Is Liability Insurance Important For Hvac Contractors?

Liability insurance protects HVAC contractors from claims of property damage or bodily injury during work.

How Much Does Hvac Contractor Insurance Cost?

HVAC contractor insurance typically costs between $400 and $2,000 annually, depending on coverage needs.

Does Hvac Insurance Cover Equipment Damage?

Yes, HVAC insurance can cover equipment damage if included in the policy.

Conclusion

Insurance for HVAC contractors is crucial. It protects your business. It builds trust with clients. It covers various risks. Make sure you get the right coverage. Assess your needs. Compare quotes. Work with an agent. Stay safe and secure with the right insurance.

| Type of Insurance | What It Covers |

|---|---|

| General Liability Insurance | Bodily injuries and property damage |

| Workers’ Compensation Insurance | Employee medical costs and lost wages |

| Commercial Auto Insurance | Vehicle accidents, theft, and damage |

| Professional Liability Insurance | Mistakes in your work |

| Tools and Equipment Insurance | Theft, loss, and damage of tools |

Key Takeaways

- Insurance protects your HVAC business.

- General liability is a must-have insurance.

- Workers’ compensation is often legally required.

- Commercial auto insurance covers your work vehicles.

- Professional liability covers work mistakes.

- Tools and equipment insurance covers your valuable tools.

- Assess your needs and compare quotes for the best coverage.

- Work with an insurance agent to find the best policies.

- Build trust with clients by having proper insurance.

- Stay safe and secure with the right insurance coverage.